Hyperinflation Threat and Small Business

Business owners generally are not economists. They are more worried about meeting payroll, taxes, insurance and growing their business.

Hyperinflation? Just a term for the “sky is falling crowd!”

There are those that believe hyperinflation is coming, each with their own series of facts and data to substantiate their positions.

According to a sobering report from the National Inflation Association, there are many reasons to be worried, and the news of potential imminent doom isn’t far flung into the future. “In our estimation, the most likely time frame for a full-fledged outbreak of hyperinflation is between the years 2013 and 2015”. (NIA, 3/26/11)

With the sheer amount of money being printed and flooding the economy (see chart below from the Fed Reserve Bank of St. Louis), the decreasing value of the U.S. Dollar will start to show its effect in commodity pricing which will have a detrimental effect on families and those living on fixed incomes.

According to the New York Times, April 11, 2011, economists are still trying to determine the longer-term economic impact of higher prices, including the current gasoline pricing.

“Once we cross the $4 threshold, the pain will become more palpable, and it is going to show up more noticeably in the reduction in future consumer spending,” said Bernard Baumohl, the chief global economist for the Economic Outlook Group. He predicted that “spending on discretionary goods will be diminishing as the price of gasoline keeps moving higher.”

What the article is discussing is the beginning stages of a slowdown in spending. Discretionary income is what people have to spend on food, products and fuel. When they simply cannot afford to fill their tank or buy food, people’s lifestyles are affected.

In his controversial blog The Truth About Hyperinflation, Cullen Roche (who does not believe hyperinflation is coming) explains:

“Contrary to popular opinion, deficit spending and high government debt levels are not the actual cause of a hyperinflation. In most cases they have been the result of other exogenous events such as ceding of monetary sovereignty, war, rampant corruption or regime change. It is these exogenous events that result in the public’s rejection of the currency, a collapse in the tax system and the government response of printing more money to fill in the confidence void. Ultimately the confidence void cannot be filled and the currency is fully rejected by the public in the form of hyperinflation.”

Hyperinflation Defined

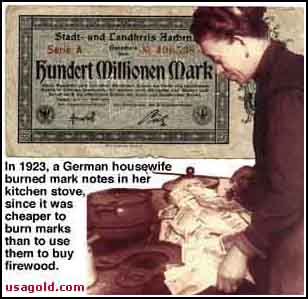

Hyperinflation occurs when a currency rapidly drops in value. Gradual inflation is normal and in fact welcome by investors and speculators. Hyperinflation is the devaluing of a sovereign currency which leads to prices spiraling out of control. Hyperinflation has happened many times in history. Commonly cited examples are the pre-World War II German Weimar Republic and Zimbabwe.

There are those that believe the economic laws are as real as the laws of gravity; specifically, when governments print more money that the economy can absorb, prices of goods and services will increase dramatically.

There are those that believe the economic laws are as real as the laws of gravity; specifically, when governments print more money that the economy can absorb, prices of goods and services will increase dramatically.

As the value of the currency that is printed en large decreases in value, the inflation is evident and confidence in the currency collapses. This can lead to a widespread destabilization of the economy and society.

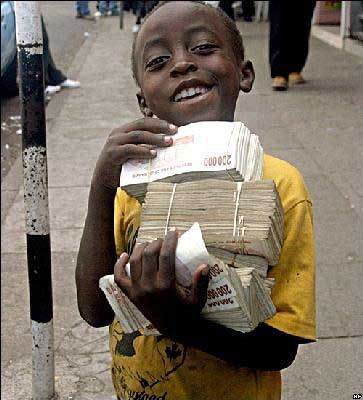

Most recent example of hyperinflation according the Business Insider:

“Zimbabwe’s annual inflation rate stood at 516 quintillion percent, according to The Telegraph. At one point the bank printed Zimbabwean dollars with a 100 trillion denomination so shoppers didn’t have to lug around sacks of cash.

Why: The nation’s inflation rate spiral went out of control because of President Mugabe’s which involved unmitigated government spending financed by theReserve Bank of Zimbabwe. Mugabe in turn blamed US and EU sanctions for the country’s economic chaos.

How it ended: In 2009 the government abandoned Zimbabwean dollars that had essentially become junk currency and allowed the use of the South African rand and the US dollar.”

Hyperinflation and small business

As demonstrated in this article, there are respected people who believe the U.S., which is continuing their Quantitative Easing programs (the flooding of financial institutions with printed cash buying up bonds and other financial instruments) and easy monetary policies, is barreling toward the inevitably of hyperinflation.

Others say no, the Fed, following current political decisions based on Keynesian theories on the economy, will resolve the threat.

The danger however is the rush up in commodity prices, such as gold and other precious metals. While people are already feeling the pinch of $4 gas prices, the reports of potential $5 a gallon prices should be concerning. This wil undoubtedly cause a slowdown in consumer and business spending, while product prices will soar.

The cost of transportation, which is built in to all products, is already at the breaking point.

The cost of transportation, which is built in to all products, is already at the breaking point.

The potential of hyperinflation is very real and business owners should be aware, at the very least, of the threat.

Who’s right? Let’s hope the answers are not found in history books costing thousands of dollars.

(A terrific read on this is an interview with Marc Faber on the Federal Reserve and Hyperinflation.)

Topics: Fiscal Policy, Small Business Economic Report, , inflation, monetary policy, Small business

Leave a Reply