U.S. in ‘The Lego Economy’: Everything is Awesome!

I recently watched The Lego Movie with my kids (yes, I’m playing catch up). I admire Lego. A mere decade ago, almost bankrupt and on the precipice of ruin, Lego came back to rule the global toy market, all while promoting kids independence and imagination.

The movies’ message of ‘thinking for yourself’ is right in line with how parents try to raise their kids. For example, I want my kids to ascertain right from wrong & truth from fiction. If kids can learn when they are being lied to, they will make better life decisions.

The Lego Movie intelligently exemplified ‘art imitating life’; what is presented to the masses may not always be what it seems.

For example: Politicians and the mainstream media are delivering the economic version of Everything is Awesome! to weary & exhausted U.S. denizens who desperately seek good economic news.

The message is repeatedly presented as fact.

Compared to 2009, it is a fact that the economy has improved. Fewer homes are being foreclosed. More people working. Banks and corporations are more solvent and are sitting on large amounts of capital. The stock market has doubled resulting in increased paper wealth.

Therefore, the U.S. is heading in the right direction. We have “turned the page”.

Bouncing up a few feet from an ocean trench, doesn’t mean you are close to the surface.

(Mild spoiler alert!) Much like The Lego Movie, underneath the glossy veneer and happy messaging, everything is NOT awesome.

In recent months reliable economists have voiced concerns the U.S. is entering a dangerous and unprecedented period. The causes of the 2008 collapse still remain today. The actions of the Federal Reserve simply have propped up an economy on wobbly stilts and just temporarily shifted the deck chairs on the Titanic. A darker analogy: Like a patient with terminal cancer switching to a more effective chemotherapy, they may feel better for a short while, until the cancer spreads with a vengeance.

The problem with talking economics in a challenging economy is that it becomes politicized. People get behind their elephant or donkey no matter what the facts may be. In reality, there were several reasons why the 2008 financial crisis occurred (see below), and both political parties can claim their share of blame.

Most would agree that the symptoms of the problem was the overextended debt levels borne by consumers which caused bank failures when the house of cards crashed.

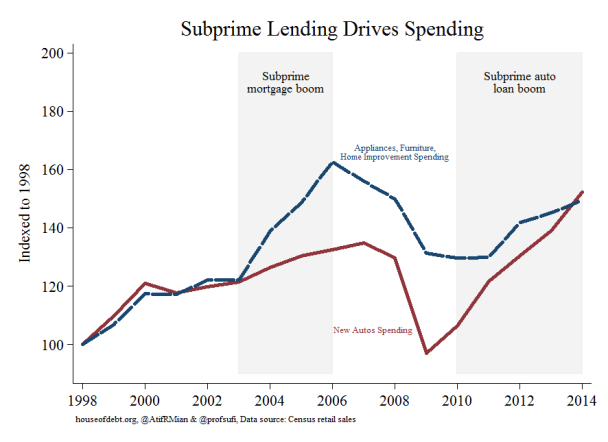

Many would remember these type of offers:

– Need a new car but no credit? No Problem! Subprime auto lending is available. Just sign and drive!

– Require a student loan? Just sign and learn!

– Want a house but don’t have the 20% down payment? FHA 3% down loans are available. Just sign and move in!

It’s good that banks learned their lessons and would never put themselves in the same position that lead to the crisis.

Except, these offers were not from 2008. They are from 2015.

The word “bubble” is appearing again. Bubbles, economically speaking, are dark and foreboding. The last 2 bubbles were the 2000 ‘dot-com’ boom/bust and then the financial collapse of 2008.

Bubbles are not accidental. They are caused by policies created by human beings. Those humans are typically in government or central banking. When governments or central bankers start to fiddle with the natural law of free enterprise or pre-existing laws that maintained the integrity of the economy, it usually leads to a game of musical chairs; There will always be a loser. In most cases, those are middle-class tax payers.

We’ve had two huge bubbles that collapsed already in this century. When this third bubble collapses—and surely it will—I believe that will be the day of reckoning. The credibility of all this central-bank-dominated, Wall-Street-coddling policy will be totally repudiated, and maybe then we can clean the slate and start over.” -David Stockman: Former Head of OMB

How Did It Happen?

In the late 1990’s Wall Streets titans successfully lobbied the President and Congress to repeal the one great protection the economy had: The Glass-Steagall Act. The 1933 law passed after the Great Depression to separate investment banks from commercial banks. The 1990’s repeal resulted in smaller banks incentivized to make riskier loans as they were assured financial institutions would ultimately buy their risky debt portfolios.

Immediately after the repeal of Glass-Steagall, early 2000, the U.S. entered into the ‘dot-com’ bust/recession (not related). Then the U.S. was hit with devastating attacks on 9-11-01. The Chairman of the Federal Reserve, Alan Greenspan informed the world that America is still open for business by lowering interest rates.

The government increased the number of lower income home loans GSE’s (Government Sponsored Enterprises-Freddie and Fannie) would buy. EVERYONE had the right to own a home. The revised regulations made it easier for individuals to purchase single family residences. To facilitate lessor credit-worthy buyers, seldom used alternative financing options, such as sub-prime, suddenly became ubiquitous. Banks were more comfortable providing these risky loans as they knew GSE’s or Wall Street firms would gobble them up.

The witches brew was created: Low interest rates, easy-qualification loans, and small banks able to unload their debt portfolios to the eager GSE’s or investment banks.

We all know how this experiment ended.

Washington and the mainstream media: ‘The ‘crisis’ is in our review window’.

Unemployment is down, the stock market has doubled and, well… Everything Is Awesome!!!

Except…

While Wall Street and the Fortune 100 are enjoying increased profits, small business owners still find cash flow slow, competition is as fierce as ever and profit margins shrinking. In addition, the regulatory atmosphere has mushroomed. In just 2014 there were almost 4,000 new or expanded regulations on business, including the often changing health care laws.

The regulatory atmosphere, along with newly implemented programs has made the small business owner wary of further investment. Whatever one’s opinion is of the new health care laws, no one can argue with the widespread confusion the haphazard changes have caused.

Most notably: The Federal Reserve is involved in the largest, most expensive economic experiment in the history of the United States.

The Fed’s tools:

1. Printing money

2. Controlling interest rates

ZIRP (zero interest rate policy) and printing money to buy securities increases banks bottom lines. Consequently, with extremely low interest rates, the stock market is one of few places people are realizing returns.

THE LEGOS DON’T FIT

The problem is the record stock market is masking reality:

- Manufacturing data is sluggish.

- The National Debt has literally doubled in 6 years. At over $18 Trillion, the debt per tax payer is over $154,000.

- Multi-national companies had a series of disappointing earning results.

- GDP is much lower than is considered ‘healthy’. (4th q. 2%)

- The trade gap has widened. U.S. products are becoming more expensive for foreign markets.

- Durable orders are down.

- Wages are lower than 2007.

- Business investments has cooled. Business spending on equipment fell at the largest contraction since early 2009.

- U.S. Consumer spending just recorded it’s biggest decline since late 2009, with cheaper gas not translating to higher activity.

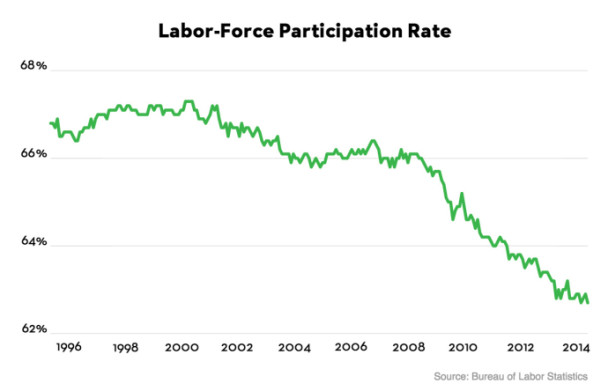

- The Labor-Force Participation Rate is at the lowest level in almost 40 years. (Fewer people in the workforce lowers Unemployment Rate)

Lack of wage growth and employment market is a major issue. Partisans would say, “unemployment is down!” Yes, technically. (The formula for unemployment does NOT include folks that are no longer on the unemployment rolls, stopped looking or working under the table). The reality about unemployment is that there are now fewer people in the labor force as a percentage of working adults, than since the days of Jimmy Carter. Gallup calls Unemployment: The Big Lie.

Therefore, small business owners are watching with trepidation before making decisions in hiring and capital expenditure. As small business owners represent 67% of employers, there can be no REAL recovery until Main Street feels confident again.

So next time you see the politicians and pundits suggest “Everything is Awesome”, determine truth from fiction.

Today we must challenge ourselves to be aware of the big picture and formulate our own opinion.

Tweet Share

Topics: Economy, Fiscal Policy, Small Business, , bubble, economy, Fed, Glass-Steagall, interest rates, Lego, Politics

Leave a Reply