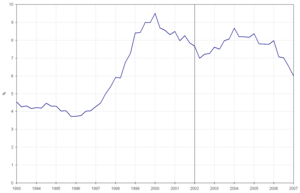

Short Cash Flow Problems Will Cause Unemployment to Remain High

Short Cash Flow Problems Will Cause Unemployment to Remain High

| The U.S. economy can not rebound while capital is not being provided from banks to small business. Slowdowns in receivables are causing loan applications to be denied. Alternative capital sources now needed and are being provided by Experts. |

Small Business Needs Capital

According to Equifax (11/02/09) “Commercial bankruptcies among the nation’s more than 25 million small businesses increased by 44% from the third quarter of 2008 to the third quarter of 2009”

The primary concern for small business is cash flow. Receivables have slowed dramatically. Valcor Arbitration Services provides business Debt Restructuring and Mediation to small businesses have seen a dramatic increase in the number of cases throughout North America.

Valcor CEO David H. Sussman, states “the normal daily challenges facing small businesses have now been dwarfed by a tremendous slowdown in cash flow. Clients are extending out payments from a normal 30-60 day cycle to 90-120 day and even further. This is having a damaging effect on the small business as they need capital to invest in product and services, payroll, marketing and new product development. Now businesses are simply in survival mode”.

Mr. Sussman continues “The biggest problem is that many of these businesses cannot secure financing from their dependable sources such as their established banking relationships. Banks are lending at the lowest level in years as they are extremely risk adverse. So along with the slowdown in receivables, the shutdown in business loans, and the economy still suffering from the effects of this recession, the small business owner is experiencing the perfect storm.”

Valcor has been proactive with it’s clients and sought out alternative lenders which are seeking to lend money to established businesses. While some of these funds are North American based, with the decline in the U.S. dollar, Valcor has sources that are international in nature.

This has provided Valcor’s clients the ability to secure much needed capital at competitive terms, when they were originally turned down by their local community lenders.

Mr. Sussman suggests to any business seeking to increase cash flow to contact Valcor and a Senior Consultant will provide a no-obligation consultation. Valcor never charges any upfront fees for it’s services.

Topics: Small Business, Small Business Economic Report, , Business, business financing, Insurance, loans, Small business, unemployment

Leave a Reply